Financial management is an integral part of ensuring financial security and independence. In our digitally connected world, this has become increasingly streamlined, thanks to a plethora of money management apps.

Cash App has been a popular choice among these, offering simple and instant transactions. It has changed the dynamics of how we handle money, making it possible to send and receive funds at the touch of a button.

However, it’s not without its limitations. Aspects like limited functionalities and inconsistent fees can often be a hindrance to users, making it essential to survey the market for alternatives. In the quest to aid you in finding a suitable platform, we will delve into 12 top Cash App alternatives in this post.

Why Do You Need a Cash App Alternative?

There are several reasons why you might need a Cash App alternative. First, Cash App’s functionalities can be restrictive for some users.

- For example, it does not offer budgeting tools or investment options that are essential for comprehensive financial management.

- Second, Cash App has been reported to have occasional technical issues, causing inconvenience during urgent transactions.

- Lastly, the app charges fees for instant transfers, which can quickly add up for frequent users.

Therefore, finding an alternative that better suits your specific needs can provide you with more financial flexibility and control, and potentially even save you money.

The good news is you can get about more or less the same results with all the Cash App alternatives I’m about to discuss. So without any ado, let’s jump in!

| App | Fees | Features | Security | Availability |

| Wise (formerly TransferWise) | Low fees for international transfers | International money transfers, multi-currency accounts | Regulated by Financial Conduct Authority (FCA) in the UK | Worldwide |

| Payoneer | Free for most transactions, 3% fee for international transfers | P2P payments, international payments, invoicing | Regulated by Financial Crimes Enforcement Network (FinCEN) in the US | Worldwide |

| PayPal | Free for most transactions, 3% fee for international transfers | P2P payments, online shopping, in-store payments | FDIC insured, PayPal’s security infrastructure | Worldwide |

| Venmo | Free for most transactions, 3% fee for instant transfers | P2P payments, split bills, buy and sell goods, support for businesses | FDIC insured, end-to-end encryption | United States |

| Zelle | Free for most transactions | P2P payments | FDIC insured, bank-to-bank transfers | United States |

| Xoom | Low fees for international transfers | International money transfers, in-store payments | Regulated by Financial Crimes Enforcement Network (FinCEN) in the US | Worldwide |

| Revolut | Free for most transactions, 3% fee for international transfers | P2P payments, foreign exchange, budgeting tools | Regulated by Financial Conduct Authority (FCA) in the UK | Worldwide |

| Dwolla | Low fees for most transactions | P2P payments | FDIC insured, Dwolla’s security infrastructure | United States |

| Paysend | Low fees for international transfers | International money transfers, multi-currency accounts | Regulated by Financial Conduct Authority (FCA) in the UK | Worldwide |

| Google Pay | Free for most transactions, 3% fee for instant transfers | P2P payments, contactless payments, online shopping | FDIC insured, Google’s security infrastructure | Worldwide |

| Apple Pay | Free for most transactions, 3% fee for instant transfers | P2P payments, contactless payments, online shopping | FDIC insured, Apple’s security infrastructure | United States, Canada, Australia, United Kingdom, Japan, China, and 25 other countries |

Table of Contents

12 Best Cash App Alternatives

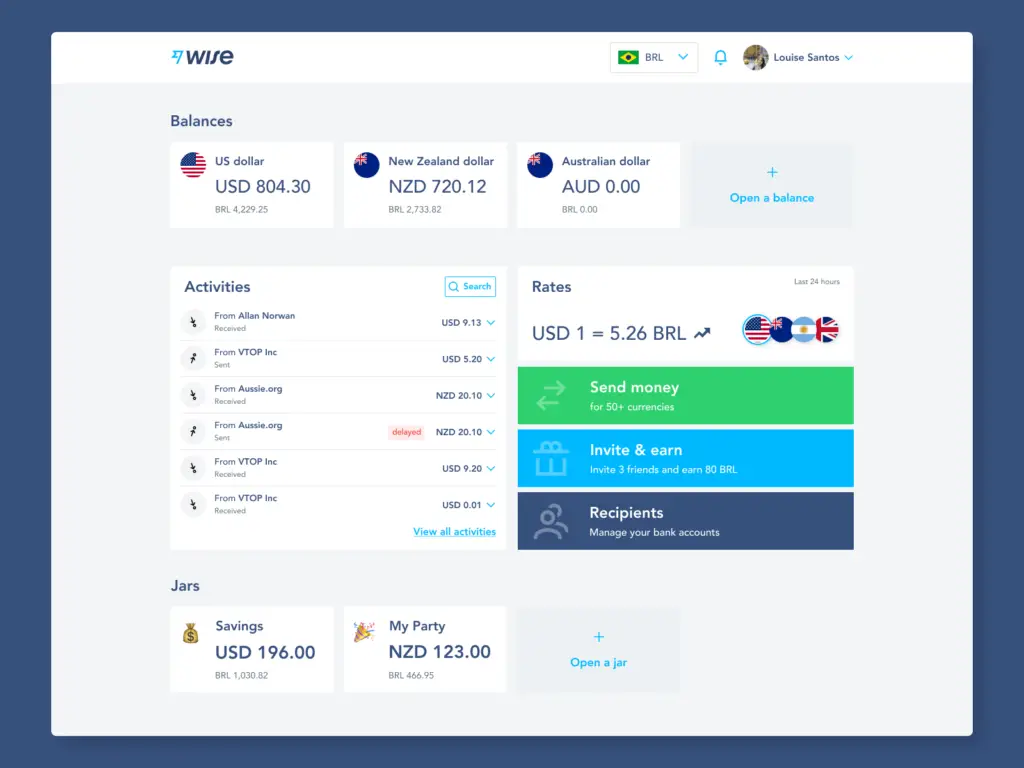

1. Wise

With transparent fees and exchange rates, Wise (formerly TransferWise) is a great option for international money transfers. It’s also easy to use and offers cheap ATM withdrawals. This is an ideal cash app alternative for individuals who regularly transact in foreign currencies.

Wise is acclaimed for its transparent fee structure and real mid-market exchange rates, mitigating the usual high costs associated with international transfers. The beauty of Wise lies in its multi-currency account feature that allows users to hold, receive, and send money in multiple currencies, making it a convenient option for travelers or expats.

Notably, Wise provides a debit card for easy ATM withdrawals and purchases, further enhancing the user experience. The platform has robust security measures in place, providing assurance that your funds are in safe hands. Wise stands as a compelling choice.

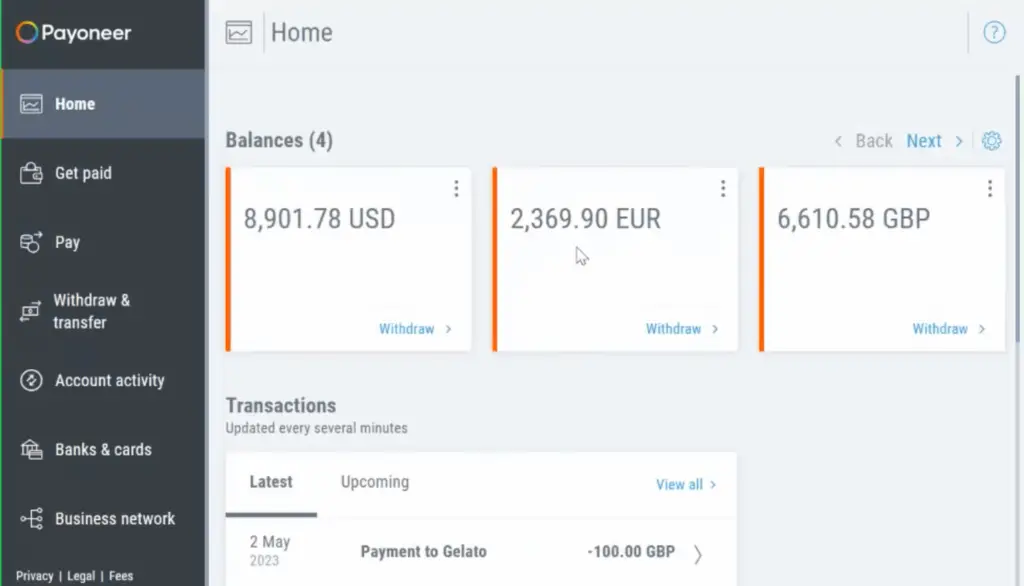

2. Payoneer

If you’re a freelancer or a small business owner, Payoneer could be an invaluable asset for managing your finances. This platform facilitates seamless transactions in numerous currencies, accommodating a global clientele. Its capability to handle cross-border payments makes it an ideal Cash App substitute for those operating internationally.

Payoneer is equipped with a robust and user-friendly interface, making it easy to navigate and process transactions. It has an esteemed reputation for its rapid transfer times, meaning you won’t have to worry about delays in payments reaching your account.

Perhaps the most significant advantage of Payoneer is the absence of transfer fees when moving funds to your bank account. This feature can lead to substantial savings for frequent users, making it an economically viable choice. The platform also offers a prepaid Mastercard, allowing for easy access to your funds, which can be particularly useful for business expenses or personal use.

In terms of security, Payoneer is not one to compromise. The app maintains high-level security measures, ensuring that your financial data and transactions are well protected. With its broad range of features and secure framework, Payoneer stands as a strong contender in the list of Cash App alternatives.

3. PayPal

PayPal is not just a trusted name; it’s a pioneer in the digital payment sector. For years, it has facilitated seamless transactions, making it a preferred choice for many individuals and businesses worldwide. It’s a highly versatile platform that caters not only to consumers but also to small business owners and freelancers.

With PayPal, you can send, receive, and access your money from almost anywhere in the world. Its global presence makes it a great choice for users operating internationally. The platform also ensures a high level of security, with measures in place to protect transactions and personal data, which can give users peace of mind.

One of the standout features of PayPal is its ability to generate and send invoices, making it an excellent tool for businesses and freelancers. It also provides a debit card option, which makes accessing your funds convenient and straightforward.

It’s important to note, however, that while PayPal offers numerous benefits, it also has its drawbacks. The platform has been known to charge high fees for currency conversions, which can be a significant drawback for individuals or businesses dealing with international transactions regularly. However, its overall convenience, versatility, and reliability make PayPal a strong contender in the list of Cash App alternatives.

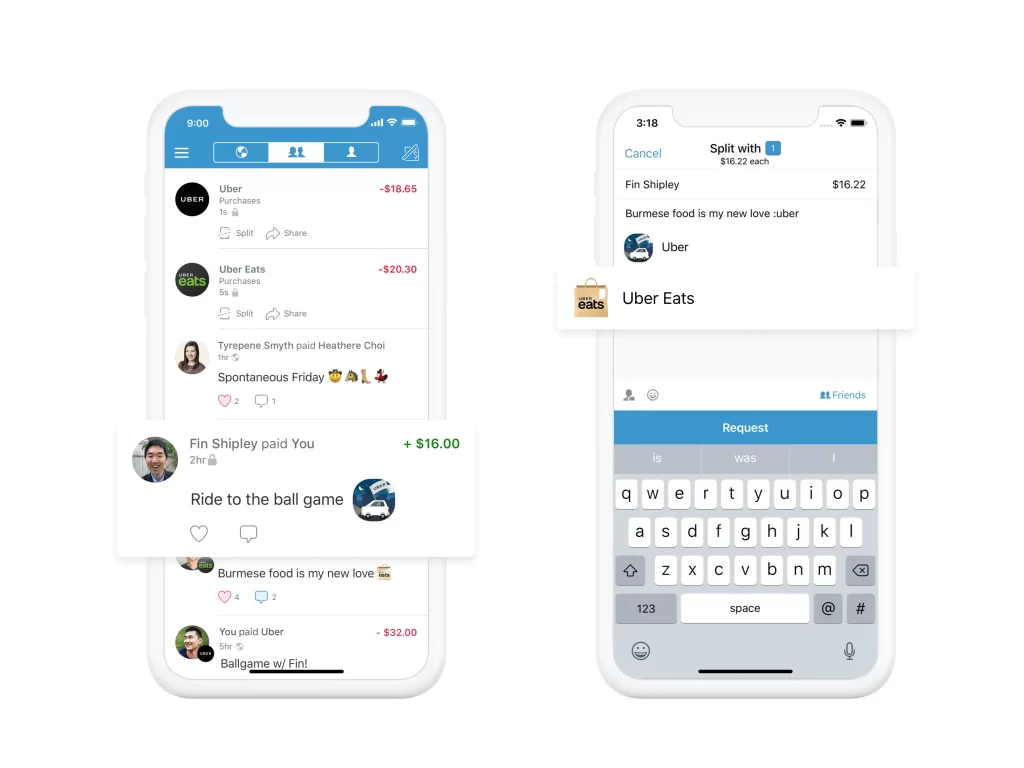

4. Venmo

Venmo, a mobile payment service owned by PayPal, has gained significant traction due to its unique blend of financial transactions and social interactions. The platform allows users to share their payment activity on a social feed, making the process of money exchange more engaging and transparent.

One of the key benefits of using Venmo is its user-friendly interface. The platform is intuitive and easy to navigate, making the process of sending, receiving, and requesting money a breeze. Venmo also offers the option to split payments with friends or family members, which can be particularly useful for dividing costs for shared expenses like rent, meals, or utilities.

In terms of security, Venmo uses encryption to protect user data and provides options to set up PIN codes for mobile applications. However, users should be cautious about sharing their transaction details on the social feed to ensure their financial privacy.

5. Zelle

Zelle has emerged as a popular Cash App alternative, especially for users who prioritize swift transactions. This unique platform is a result of collaboration among several major U.S. banks, providing a trustworthy and reliable foundation for your financial transactions.

One of Zelle’s most compelling features is its speed – money sent via Zelle can often be available in the recipient’s bank account within minutes. This can be particularly beneficial for time-sensitive payments. Furthermore, since many major U.S. banks are integrated with Zelle, it’s likely that you can use this service directly from your bank’s app, providing an extra layer of convenience.

Unlike some other platforms, Zelle doesn’t charge any fees to send or receive money, which certainly makes it a cost-effective choice. Its simple, user-friendly interface makes navigating transactions straightforward, even for those who may not be tech-savvy.

In terms of security, Zelle offers robust protection. The app uses encryption and secure channels to transfer money. However, it’s worth noting that Zelle only supports domestic transfers in the U.S. Those who require international transactions may need to look for other alternatives.

6. Xoom

Xoom, a PayPal service, stands out in the digital payments landscape through its specialty – facilitating international money transfers swiftly and conveniently. With its presence in over 130 countries, Xoom provides its users with a global platform to transfer money, pay bills, and refill phone credits.

One of Xoom’s core strengths lies in its competitive exchange rates and low fees. These economic rates make it an attractive choice for those who frequently engage in international transactions. Furthermore, the platform also offers a ‘money-back guarantee’, ensuring that your hard-earned money reaches its destination securely.

The transaction speed is another notable feature of Xoom. The service typically ensures that the transferred funds reach the recipient within minutes, making it a reliable choice for urgent payments. Xoom also provides its users with various ways to send money – from bank accounts, debit, or credit cards, enhancing its convenience factor.

On the safety front, Xoom uses advanced data encryption and fraud prevention technologies to ensure that transactions are secure and private. However, it’s essential to note that while Xoom is a powerful tool for international transactions, it does not provide a social element like some of its counterparts.

7. Revolut

Revolut is a digital banking app that has gained popularity among frequent travelers and those involved in international transactions. It provides an alternative to traditional banking, with a focus on technology and affordability. The platform allows users to hold, exchange, and send money in multiple currencies at real exchange rates, avoiding common banking fees that can accumulate while traveling or doing business abroad.

One of the standout features of Revolut is its budgeting and analytics tools. Users can categorize their expenses, set monthly budgets, and receive instant spending notifications. This makes it easier to keep track of finances and helps encourage more responsible spending habits.

Revolut also offers a unique feature called Vaults, which allows users to round up their spare change and save it for a future date, making saving money effortless and automatic. Furthermore, the app supports cryptocurrency transactions, appealing to those interested in digital assets.

In terms of security, Revolut uses advanced technologies like device insurance and disposable virtual cards to protect the user’s money and data. It also offers the functionality to instantly freeze and unfreeze your card directly from the app, providing additional safety measures.

8. Dwolla

Dwolla is a robust payment platform designed for businesses, offering seamless money transfers with an emphasis on scalability and security. What sets Dwolla apart is its comprehensive API that allows businesses to incorporate its payment functionality directly into their own applications.

Dwolla’s unique selling proposition lies in its ability to facilitate free money transfers, making it an attractive option for small businesses and start-ups looking to minimize transaction costs. The platform also offers customizable payment solutions that can be tailored to the specific needs of a business, giving it flexibility and control over its financial transactions.

The platform prides itself on its exceptional customer support, offering dedicated assistance to ensure smooth and hassle-free transactions. It also employs advanced security measures, such as data encryption and two-factor authentication, to ensure the safety of each transaction and protect user data.

However, it’s worth noting that Dwolla currently only supports domestic payments within the U.S., making it unsuitable for those looking to transfer money internationally. Furthermore, some of its services are only available in select states, so make sure to check if Dwolla is available in your area before signing up.

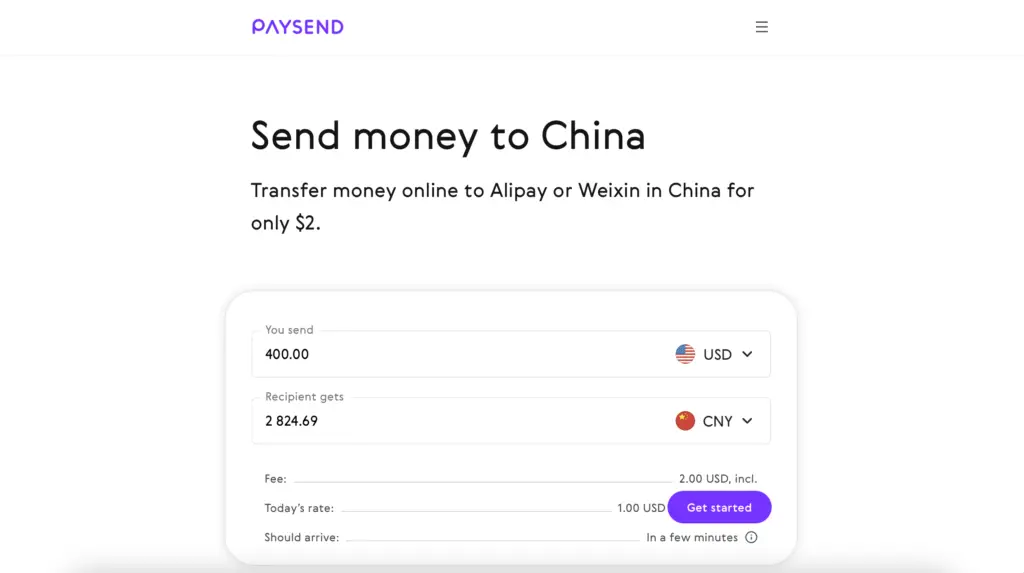

9. Paysend

Paysend is a global fin-tech company that offers innovative solutions for international money transfers. With its global coverage spanning over 100 countries, Paysend allows users to send money abroad at competitive rates and minimal fees, all from the convenience of a mobile app.

A distinguishing feature of Paysend is its simplicity. The service enables users to transfer money to bank accounts, Visa, MasterCard, UnionPay cards, or to digital wallets, without the need for SWIFT codes or other banking details, making it highly user-friendly.

In terms of speed, Paysend stands out with its instant transfers. This ensures that beneficiaries can receive funds without any delay, which can be crucial during emergencies.

When it comes to security, Paysend employs top-notch measures. They use 3D Secure technology to protect online transactions and have authorization from the UK Financial Conduct Authority, bolstering the trust users place in them. However, while Paysend shines for international transfers, it does not provide options for direct peer-to-peer transactions within the same country.

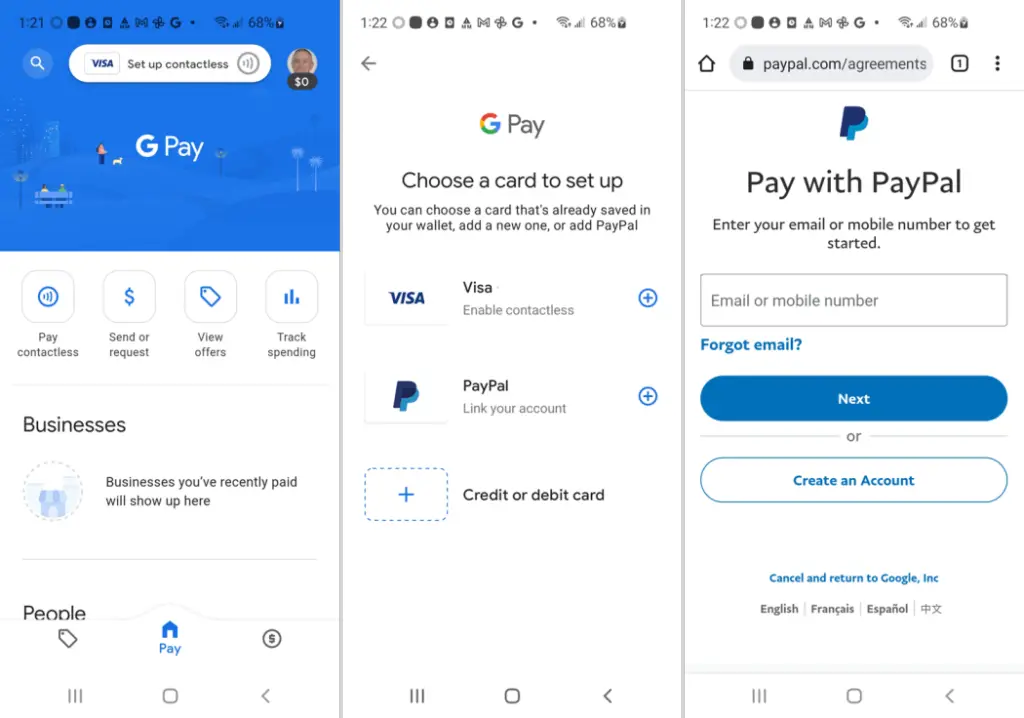

10. Google Pay

With Google Pay, you can send and receive money using just your phone number. It also offers cashback rewards and integration with other Google services.

Google Pay, developed by tech giant Google, is a digital wallet platform and online payment system that streamlines financial transactions. Its convenient and user-friendly interface allows users to make purchases on e-commerce sites, conduct peer-to-peer transactions, and even pay at physical stores using their smartphones.

One of the primary advantages of Google Pay is its seamless integration with other Google services, offering an all-encompassing ecosystem for users. The app supports wide-ranging payment sources, including credit, debit, and gift cards, thus accommodating various user preferences.

In terms of security, Google Pay is robust and reliable. It uses tokenization technology, replacing your card number with a token to secure your financial information during transactions. Additionally, it offers a ‘Find My Device’ feature that allows users to remotely lock their device, sign out of their Google account, or erase personal information if the device is lost or stolen.

However, it is worth noting that Google Pay’s services are region-specific and might vary across countries. Therefore, users are advised to check the availability of certain features in their regions before using the app.

11. Apple Pay

Apple Pay, the proprietary digital wallet service by Apple Inc., provides an easy and secure way to make payments using Apple devices. This service enables users to make payments in person, in iOS apps, and on the web using Safari. It’s compatible with most credit and debit cards from top banks and card providers, widening its accessibility to a broad user base.

One of the key benefits of Apple Pay is its user-friendly design. Payments can be made with just a touch using Touch ID or a glance using Face ID, making transactions fast and hassle-free.

In terms of security, Apple Pay demonstrates a strong commitment to user privacy and security. It utilizes a method called tokenization to secure card information. When you add a credit or debit card to Apple Pay, the actual card numbers are not stored on the device or on Apple servers. Instead, a unique device account number is assigned, encrypted, and securely stored in the Secure Element, an industry-standard, certified chip designed to store your payment information safely on your device.

However, while Apple Pay offers a host of benefits, its limitation lies in its compatibility – it’s exclusive to Apple devices, thus restricting its user base. Also, the availability of Apple Pay varies by country and region, which means it’s essential for potential users to check whether their location supports the service.

Conclusion

While Cash App may be a popular option for sending money, it’s important to consider all the factors and drawbacks of the app before choosing to use it.

Each of these applications brings unique features and benefits to the table, aiming to provide you with more control over your money. Our goal is to empower you to make a well-informed decision about managing your finances, helping you navigate your financial future with confidence and ease.

With these 12 Cash App alternatives, you’ll have more control over your funds and can find an option that best fits your financial needs. Whether you prioritize affordable exchange rates, privacy, or additional features like budgeting tools, there’s an app on this list that’s perfect for you.